Introduction to Renewable Energy and Cryptocurrency

Overview of Renewable Energy Sources

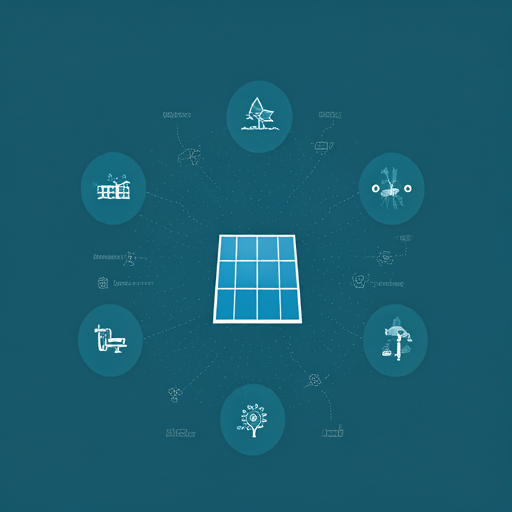

Renewable energy sources, such as solar, wind, and hydroelectric power, are increasingly recognized for their potential to transform energy markets. These sources offer sustainable alternatives to fossil fuels, reducing carbon footprints and enhancing energy security. This shift is crucial for mitigating climate change. It’s a pressing issue. The integration of cryptocurrency into this sector facilitates decentralized energy trading, allowing for more efficient transactions. Imagine a world where energy is traded like stocks. Moreover, blockchain technology ensures transparency and traceability in energy production and consumption. Trust is essential in finance. As investors seek opportunities in this evolving landscape, understanding these dynamics becomes vital. Knowledge is power.

The Role of Cryptocurrency in Energy Markets

Cryptocurrency plays a pivotal role in modern energy markets by enabling decentralized transactions and enhancing efficiency. This innovation allows for peer-to-peer energy trading, which can reduce costs and increase accessibility. It’s a game changer. Furthermore, blockchain technology provides a transparent ledger for energy production and consumption, fostering trust among participants. Trust is crucial in any market. By utilizing smart contracts, energy agreements can be executed automatically, minimizing the need for intermediaries. This streamlining can lead to significant savings. He recognizes the potential for cryptocurrencies to facilitate investments in renewable energy projects. The future looks promising.

Investment Opportunities in Renewable Energy

Emerging Technologies and Innovations

Emerging technologies in renewable energy present significant investment opportunities. Innovations such as advanced solar paneps and energy storage systems enhance efficiency and reduce costs. This is a smart move. Additionally, developments in wind turbine technology are increasing energy output while minimizing environmental impact. Investors are paying attention. Furthermore, the integration of artificial intelligence in energy management optimizes resource allocation and consumption. This leads to better returns. He believes that these advancements will attract more capital into the sector. The potential is enormous.

Government Incentives and Support

Government incentives significantly enhance investment opportunities in renewable energy. These incentives can include tax credits, grants, and subsidies. For example:

Such support reduces initial capital costs. This makes investments more attractive. He notes that these incentives can lead to higher returns on investment. They are essential for market growth. Additionally, regulatory frameworks often favor renewable energy projects. This creates a favorable environment for investors. The landscape is changing rapidly.

Challenges Facing Renewable Energy Investments

Market Volatility and Price Fluctuations

Market volatility and price fluctuations pose significant challenges for renewable energy investments. These factors can lead to unpredictable returns, making financial planning difficult. This uncertainty is concerning. Additionally, external influences such as geopolitical events and regulatory changes can exacerbate price instability. He understands the risks involved. Investors must remain vigilant and adaptable to navigate these challenges effectively. Awareness is crucial. Furthermore, the reliance on technology can introduce additional risks, as advancements may outpace market readiness. This can create further complications.

Regulatory and Compliance Issues

Regulatory and compliance issues significantly impact renewable energy investments. These challenges can arise from varying local, state, and federal regulations. This creates confusion. For instance, permitting processes can be lengthy and complex, delaying project timelines. He recognizes the importance of understanding these regulations. Additionally, compliance with environmental standards can increase operational costs. This affects profitability. Investors must also navigate potential changes in policy, which can alter market dynamics. Staying informed is essential. Ultimately, these factors can deter investment in renewable energy projects. Awareness is key.

Cryptocurrency’s Impact on Renewable Energy Adoption

Decentralized Energy Trading Platforms

Decentralized energy trading platforms leverage blockchain technology to facilitate peer-to-peer energy transactions. This innovation allows consumers to buy and sell excess energy directly, enhancing market efficiency. It’s a revolutionary concept. By eliminating intermediaries, these platforms can reduce transaction costs significantly. This is beneficial for all parties. Furthermore, they promote the use of renewable energy sources by providing a transparent marketplace. He believes this transparency fosters trust among participants. Additionally, smart contracts automate transactions, ensuring timely payments and compliance. This streamlines operations effectively. Overall, these platforms can accelerate the adoption of renewable energy. The future is bright.

Tokenization of Renewable Energy Assets

Tokenization of renewable energy assets enables fractional ownership through blockchain technology. This process allows investors to purchase shares in energy projects, increasing accessibility. It’s a smart investment strategy. By converting physical assets into digital tokens, liquidity improves, facilitating easier trading. This attracts more capital. Additionally, tokenization enhances transparency in asset management, as all transactions are recorded on a public ledger. He appreciates the clarity this provides. Furthermore, it can lower entry barriers for smaller investors, democratizing access to renewable energy investments. This is a significant advantage.

Case Studies of Successful Investments

Notable Projects in Solar and Wind Energy

Notable projects in solar and wind energy demonstrate the potential for successful investments. For instance, the Hornsea One offshore wind farm in the UK has a capacity of 1.2 GW, powering over a million homes. This is impressive. Similarly, the Noor Ouarzazate Solar Complex in Morocco is one of the largest solar plants globally, with a capacity of 580 MW. It significantly contributes to the region’s energy needs. He notes that these projects attract substantial investment due to their scalability and sustainability. They are worth considering. Furthermore, both projects showcase advancements in technology and efficiency. Innovation drives growth.

Lessons Learned from Failed Ventures

Lessons learned from failed ventures in renewable energy provide valuable insights. For example, the Solyndra solar panel company collapsed due to high production costs and market competition. This highlights the importance of cost management. Similarly, the Cape Wind project faced regulatory hurdles and community opposition, ultimately leading to its cancellation. He recognizes that stakeholder engagement is crucial. Additionally, the failure of these projects often stems from inadequate market research and planning. Understanding market dynamics is essential. Investors must analyze risks thoroughly to avoid similar pitfalls.

The Future of Renewable Energy and Cryptocurrency

Predictions for Market Growth

Predictions for market growth in renewable energy and cryptocurrency are optimistic. Analysts forecast a compound annual growth rate (CAGR) of over 20% in the renewable sector. This is significant growth. Additionally, the integration of cryptocurrency in energy trading is expected to enhance market efficiency. He believes this will attract more investors. Furthermore, advancements in technology will likely reduce costs and improve accessibility. This is a positive trend. As regulatory frameworks evolve, they will support further adoption of these innovations. Awareness is crucial for investors.

Strategies for Investors Moving Forward

Investors should adopt diversified strategies to navigate the evolving landscape of renewable energy and cryptocurrency. Focusing on a mix of established and emerging technologies can mitigate risks. This approach is prudent. Additionally, staying informed about regulatory changes is essential for making informed decisions. He recommends engaging with industry experts to gain insights into market trends. This can provide a competitive edge. Furthermore, considering long-term investments in sustainable projects may yield substantial returns. Patience is key in investing.

Leave a Reply